utah food tax calculator

State sales tax rates. See what youll need to earn to keep your current standard of living wherever you choose to work and live.

Income Tax Calculator 2021 2022 Estimate Return Refund

Earnings or benefits of a child who is subject to this award.

. 3999 5893 8853 11742 7332. Prescription drugs however are exempt from sales taxes. Utah has been implementing tax reforms in recent years that are designed to reduce the overall tax burden on residents increasing the potential for a lower cost of living.

Rare High Demand Products. She earned her BA. Wine and spirits are stored before being shipped to the Utah State Liquor Stores.

After moving back to her hometown of Richmond Virginia she started a career in Property Management in 2011. Illinois has a lower state sales tax than 808 of. Idaho sales tax applies to the sale rental or lease of most goods and some services.

This online sales tax calculator solves multiple problems around the tax imposed on the sale of goods and services. Sales Tax Exemptions in Arizona. The housing subsidy program the Job Training Partnership Act SSI Medicaid Food Stamps General Assistance and other means-tested benefits received by a parent.

The Louisiana LA state sales tax rate is currently 445. Depending on local municipalities the total tax rate can be as high as 1145. Temporary lodging 30 days or less is taxed.

Needy Families TANF benefits from. While the Arizona sales tax of 56 applies to most transactions there are certain items that may be exempt from taxation. The basic state sales tax rate is at 47 with some additional local taxes bringing the effective rate to 59-87 depending on the location within the state.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Sales Tax Exemptions in Wyoming.

Click on a state for a detailed guide. In Wyoming certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. This page discusses various sales tax exemptions in Wyoming.

This calculator uses your information to create all necessary worksheets. Some examples of exceptions to the sales tax are. See exactly how this highly efficient operation works.

There are several exemptions to the state sales. Though sales taxes can be steep due to local parish and jurisdiction sales taxes food and medications are exempt from sales. Vermont has a 6 general sales tax but an.

Counties and cities can charge an additional local sales tax of up to 35 for a maximum possible combined sales tax of 975. The Illinois state sales tax rate is 625 and the average IL sales tax after local surtaxes is 819. The assumption is the sole provider is working full-time 2080 hours per year.

Before-tax price sale tax rate and final or after-tax price. In Arizona certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Living Wage Calculation for Salt Lake County Utah.

Food is taxed in Idaho though low-income taxpayers may be eligible for a tax credit to offset the cost of sales taxes paid on food purchases. While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation. Illinois has 1018 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Find your states sales tax requirements below. The Chicago Illinois sales tax is 1000 consisting of 625 Illinois state sales tax and 375 Chicago local sales taxesThe local sales tax consists of a 175 county sales tax a 125 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. The Chicago Sales Tax is collected by the merchant on all qualifying sales.

Compare the Cost of Living in Salt Lake City Utah against another US Cities and States. It can calculate the gross price based on the net price and the tax rate or work the other way around as a reverse sales tax calculatorThe sales tax system in the United States is somewhat complicated as the rate is different depending on the state and. In Texas prescription medicine and food seeds are exempt from taxation.

And all states differ in their enforcement of sales tax. This page discusses various sales tax exemptions in Arizona. Louisiana was listed on Kiplingers 2011 10 tax-friendly states for retirees.

In International Studies from Randolph-Macon College in 2000 and started off working in the food industry in customer service and logistics in Northern Va and later in California.

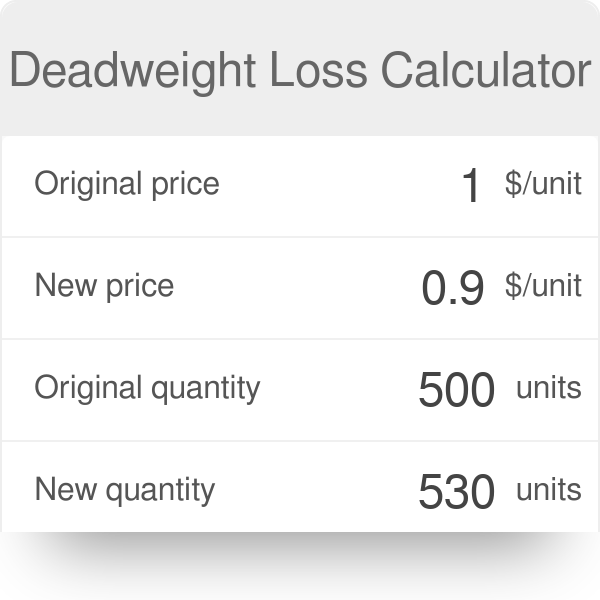

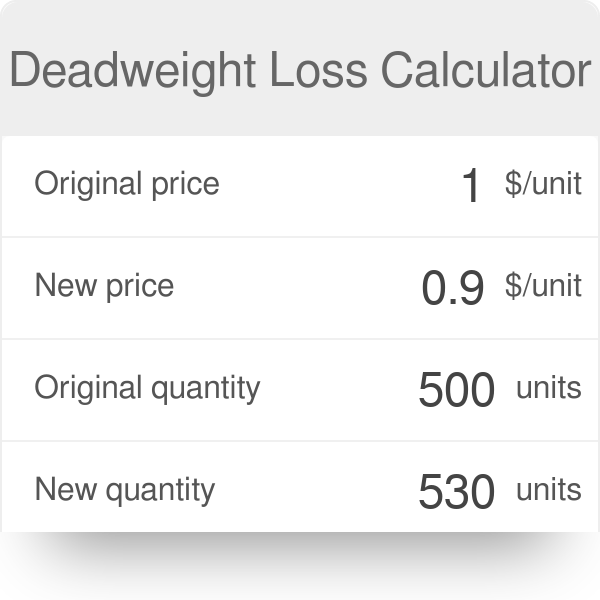

Deadweight Loss Calculator Find The Economic Deadweight Loss

Free Online 2018 Us Sales Tax Calculator For 89448 Zephyr Cove Fast And Easy 2018 Sales Tax Tool For Businesses And People From 89448 Z Sales Tax Topeka Tax

Arizona Sales Reverse Sales Tax Calculator Dremployee

California Tax Calculator Taxes 2022 Nerd Counter

How To Calculate Sales Tax On Calculator Easy Way Youtube

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

Tax Banner Images Free Vectors Stock Photos Psd

States With Highest And Lowest Sales Tax Rates

Sales Tax On Grocery Items Taxjar

Utah Sales Tax Small Business Guide Truic

Utah Paycheck Calculator Smartasset Director De Arte Agencia Publicitaria Disenos De Unas

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Free Utah Payroll Calculator 2022 Ut Tax Rates Onpay

California Tax Calculator Taxes 2022 Nerd Counter

California Tax Calculator Taxes 2022 Nerd Counter

Self Employed Tax Calculator Business Tax Self Employment Employment